41+ charitable remainder unitrust calculator

Web Upon establishing a charitable remainder unitrust you are entitled to a current income tax deduction for a portion of the value of the gift transferred to the trust which is often. Form 4720 Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code.

Catalog 03 04 Nhti Concord S Community College

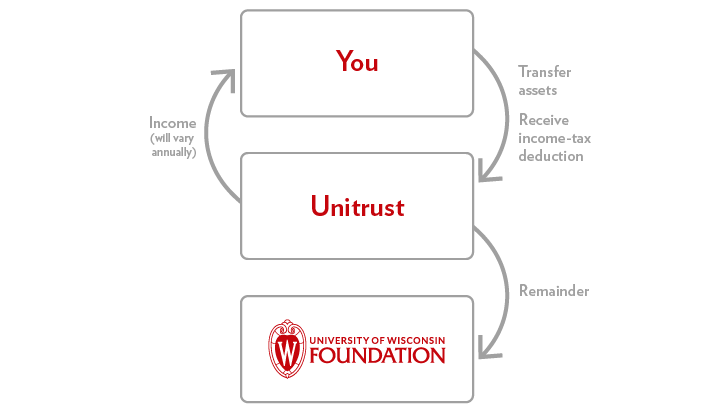

Web Income Charitable Remainder Unitrust.

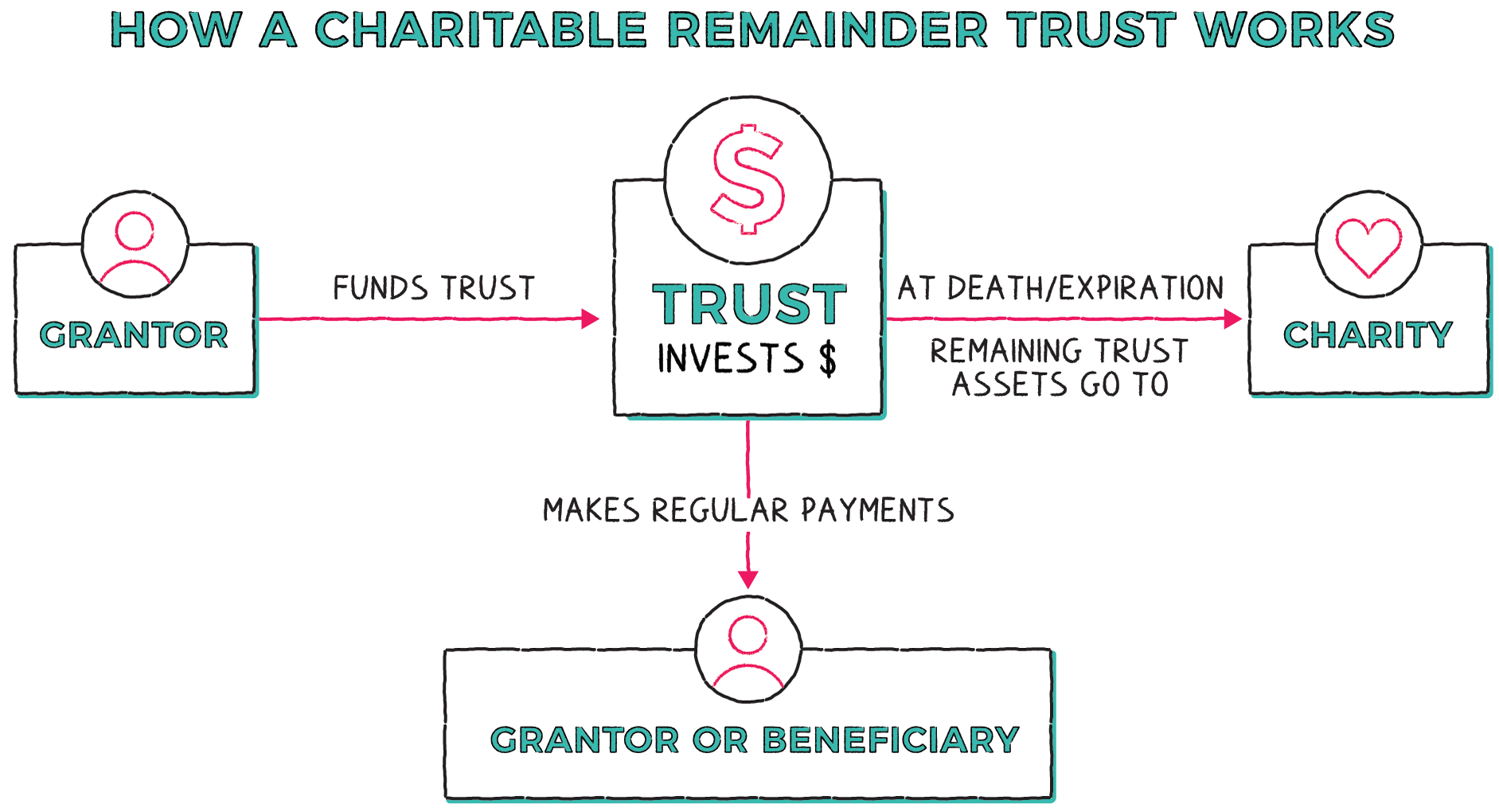

. Web Up to 25 cash back A charitable remainder unitrust also called a CRUT is an estate planning tool that provides income to a named beneficiary during the grantors life and then the. Learn how to maximize your impact with a Schwab Charitable donor-advised fund. Web Charitable Remainder Unitrusts CRUTs can be beneficial in certain instances.

Vast library of fillable legal documents. You receive an immediate. For example if the remainder factor for a charitable.

Provides the method of computing the Adjusted Payout Rate given the trusts stated payout rate and the section 7520 interest. The description would be the Unitrust- Charitable Remainder. Web A charitable remainder unitrust is a great way to protect the lands and waters you love while receiving income for life or for a fixed number of years.

Web A charitable remainder unitrust can generate income for a beneficiary as well as provide a charitable donation to a chosen charity. Web University of Georgia Planned Giving Calculator does basic calculations for charitable trusts gift annuities and pooled-income funds. Web Charitable Remainder Unitrust Calculator A great way to make a gift to the American Cancer Society receive payments that may increase over time and defer or eliminate capital gains tax.

During the unitrusts term the trustee invests the unitrusts assets. Factor from Table F based on the payment. Web The remainder factor multiplied by the funding amount equals the value of the charitable contribution.

Web For the remainder unitrust the first person is the first income recipient or beneficiary of the agreement. First Age You may enter the age of the person instead of the birth date. Web The most popular and flexible type of life income plan is a charitable remainder unitrust CRUT.

PhilantroCalc for the Web is. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity. Web When it ask what the description value and method of determining value select present value.

Web Charitable giving is widespread in the United States. Web Charitable Remainder Unitrust Calculator Healthy Living Conditions Support Professional Research Educator CPR ECC Shop Causes Advocate Giving Media Donate Now Wills. Cash securities real property or other assets are transferred into the trust.

Web The remainder value to charity must be at least 10 of the funding amount. Web A charitable remainder unitrust CRUT pays a percentage of the value of the trust each year to noncharitable beneficiaries. It provides steady cash flow and can be more beneficial than keeping an asset or selling it outright.

Instant Download and Complete your Gift Forms Start Now. Web Charitable Remainder Trust Gift Calculator - American Association for Cancer Research AACR AACR Members. Gift Amount Gift Date Payment Rate Term Based On.

Calculation of Present Value of Remainder Interest Factor. Theyre a tax-exempt Irrevocable Trust meaning they cannot be changed set up with the. Web A Net Income Charitable Remainder Unitrust NICRUT is a charitable remainder unitrust that allows for deferral of the unitrust payment as described above but does not provide for deferred distributions to be made up in future years.

Interpolation of Table U Factor for Number of Lives 1. Best tool to create edit share PDFs. The payments generally must equal at.

Americans gave over 471 billion to charities in 2020 51 more than they donated in 2019. Ad The Leading Online Publisher of National and State-specific Gift Legal Documents. Web Charitable Remainder Unitrust Calculator A great way to make a gift to Oregon State University Foundation receive payments that may increase over time and defer or.

Ad 1 PDF editor e-sign platform data collection form builder solution in a single app. Voting is open through February 28 for AACR President Board.

When To Use Charitable Remainder Trusts Morningstar

What Are The Effects Of Sade Sati And Shani Mahadasa What Happens When Sade Sati Is Over Quora

Charitable Remainder Unitrust University Of Wisconsin Foundation

Pdf Evidence On The Main Factors Inhibiting Mobility And Career Development Of Researchers

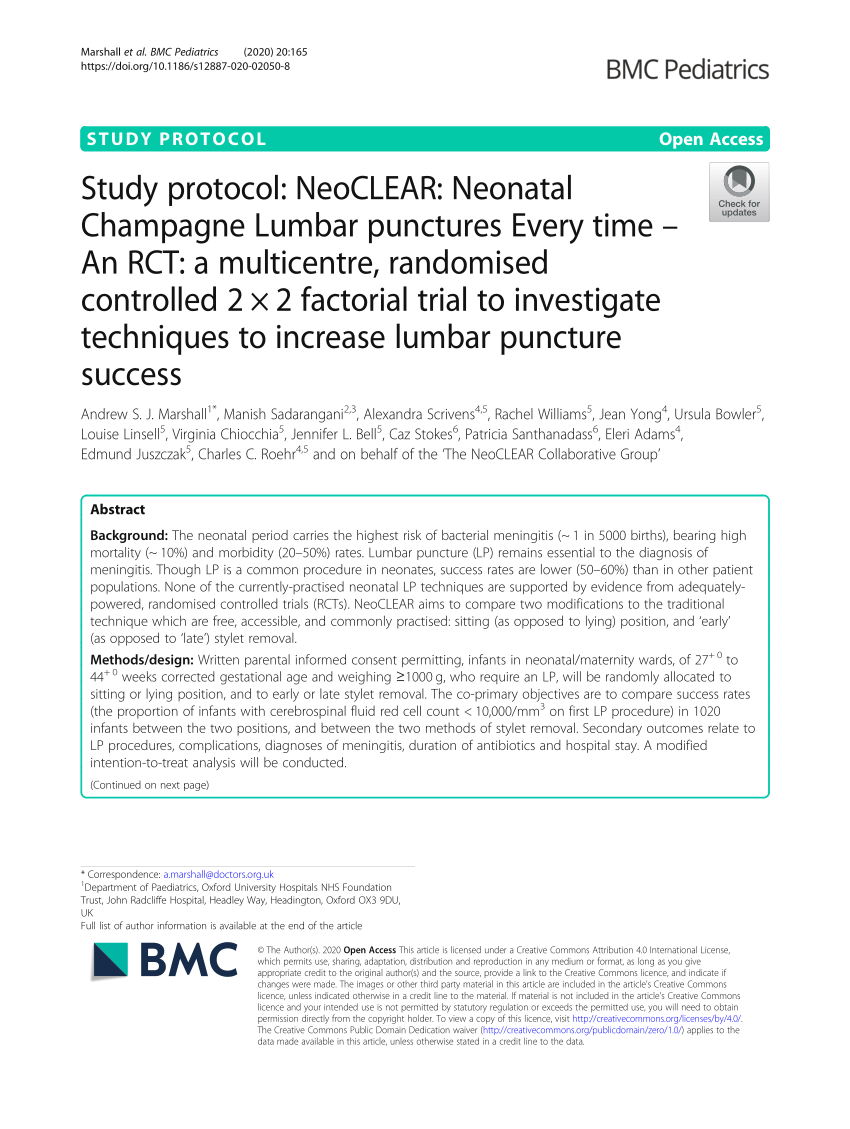

Pdf Study Protocol Neoclear Neonatal Champagne Lumbar Punctures Every Time An Rct A Multicentre Randomised Controlled 2 2 Factorial Trial To Investigate Techniques To Increase Lumbar Puncture Success

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

What Are The Effects Of Sade Sati And Shani Mahadasa What Happens When Sade Sati Is Over Quora

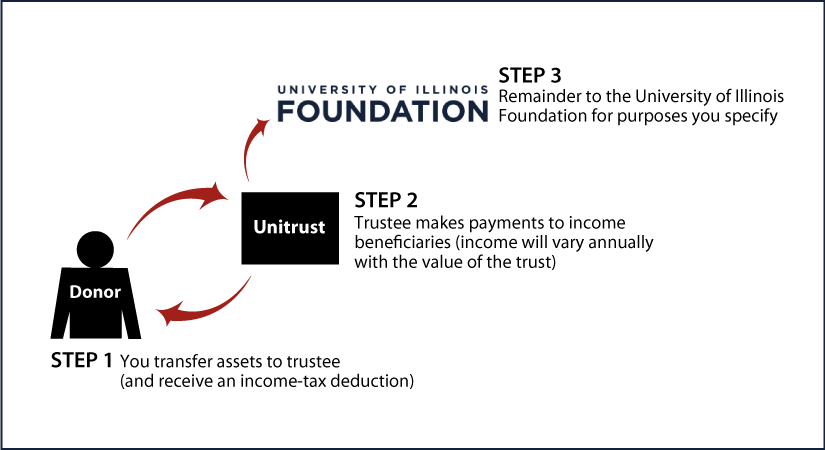

Is A Charitable Remainder Trust Right For You Napkin Finance

Pdf New Social Policy Agendas For Europe And Asia Katherine Marshall Academia Edu

Charitable Remainder Trust Calculator Garden State Trust Company

Charitable Remainder Trusts The University Of Pittsburgh

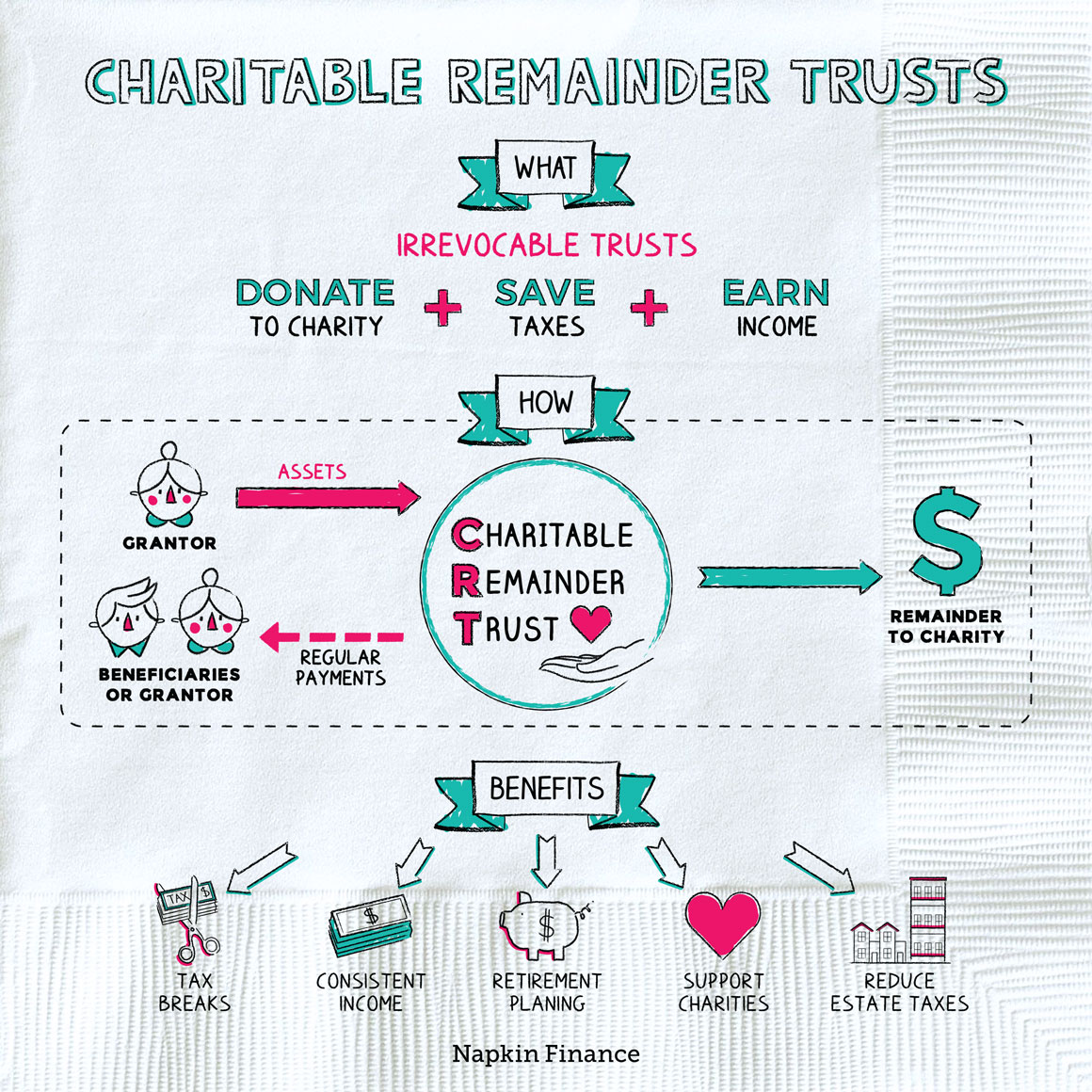

Cor2100 Economics And Society Full Notes Cor2100 Economics And Society Smu Thinkswap

Charitable Remainder Unitrust Crut Philanthropies

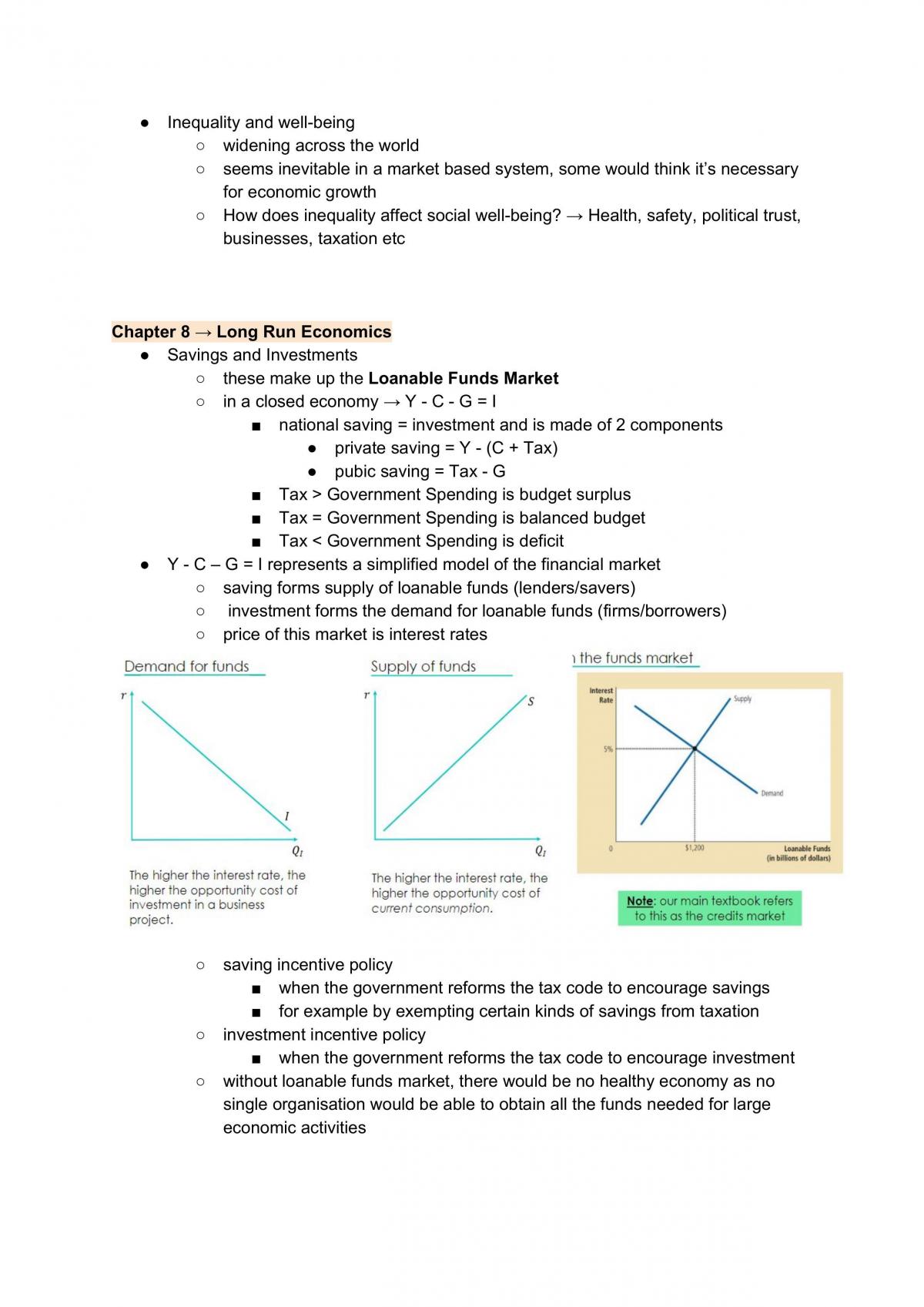

Charitable Remainder Unitrust Archdiocese Of New York

Charitable Remainder Unitrust

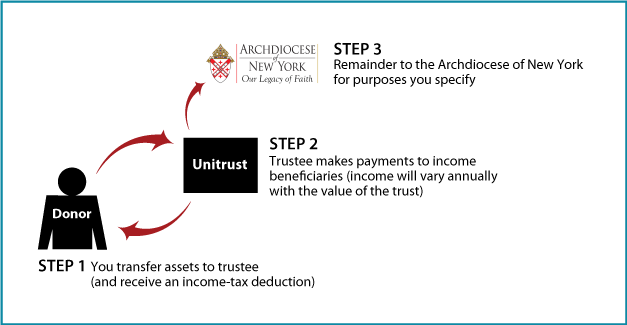

University Of Illinois Foundation Gift Planning Charitable Remainder Unitrust

Is A Charitable Remainder Trust Right For You Napkin Finance